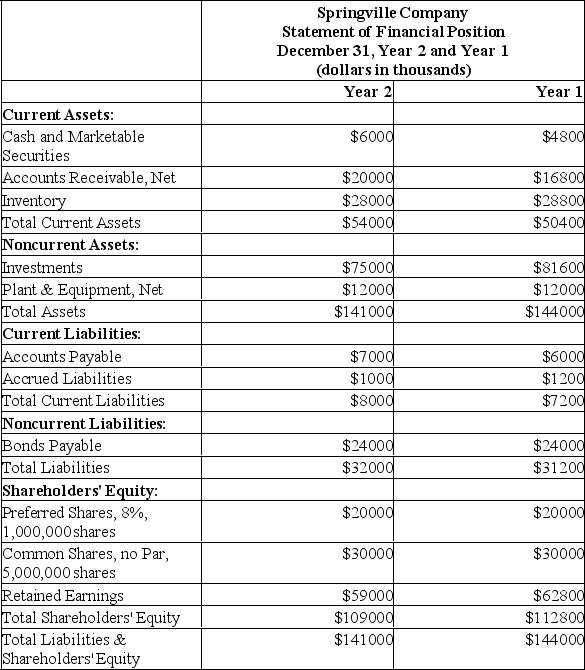

Comparative financial statements for Springville Company for the last two years appear below.The market price of Springville's common shares was $25 per share on December 31,Year 2.During Year 2,dividends of $2,000,000 were paid to preferred shareholders and $10,000,000 to common shareholders.

Required:

Calculate the following for Year 2:

a)Dividend payout ratio.

b)Dividend yield ratio.

c)Price-earnings ratio.

d)Accounts receivable turnover.

e)Inventory turnover.

f)Return on total assets.

g)Return on common shareholders' equity.

h)Was financial leverage positive or negative for the year? Explain.

Definitions:

Q7: The biggest disadvantage of the sole proprietorship

Q18: The cost of resources that has no

Q19: Last year,Jabber Company had a net income

Q45: Muffin's Masonry,Inc.'s balance sheet lists net fixed

Q54: How much will the company's operating income

Q63: What were Division A's sales?<br>A) $125,000.<br>B) $200,000.<br>C)

Q87: You have been given the following information

Q101: The SP Company makes 40,000 motors

Q143: The acid-test ratio is a test of

Q174: Assume the special equipment will have