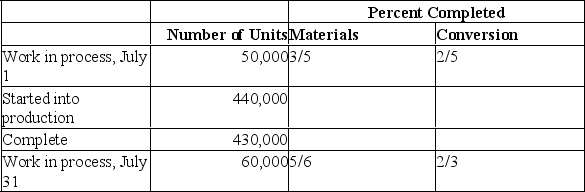

The Hardy Company manufactures a product that goes through two departments prior to completion.The following information is available on work in one of these departments,the Moulding Department,during the month of July:

Definitions:

Predetermined Overhead Rate

A calculated rate used to assign overhead costs to products or services, based on estimated costs and activity levels.

Machine-Hours

The total time that machines are running in a production process, often used as a basis for allocating manufacturing overhead costs.

Job-Order Costing System

An accounting method that tracks costs individually for each job, suitable for companies producing unique or custom products.

Predetermined Overhead Rate

A rate calculated before the manufacturing process begins, used to allocate manufacturing overhead costs to individual units of production based on a certain basis (e.g., machine hours or labor hours).

Q4: What is the break-even point in sales

Q21: How much of any underapplied or overapplied

Q38: Setting up equipment is an example of

Q50: What should be the total variable overhead

Q61: What is the best estimate of the

Q64: Which of the following would be considered

Q65: Significant reductions in committed fixed costs can

Q87: What is the variable expense per unit?<br>A)

Q109: A shift in the sales mix from

Q109: Winder Company uses the FIFO