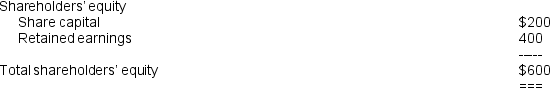

On July 1 20X5,Helios Ltd acquired all of the share capital of Havers Pty Ltd (100,000 shares) for $10 per share.During the year ended June 30 20X6,Helios Ltd received a dividend from Havers Ltd of $60,000; a dividend which had been declared by the directors of Havers Ltd in the year ended June 30 20X5 and was not subject to ratification by the shareholders of Havers Ltd.During the year ended June 30 20X6,Helios Ltd received an interim dividend of $40,000 from Havers Ltd and the directors of Havers Ltd declared a final dividend of $60,000.At June 30 20X6,The directors estimated that the fair value of the shares in Havers Ltd was only $9 per share at that date,but the estimated fall in value was considered to be only temporary and the carrying amount of the investment had not been impaired. At the date of acquisition,July 1 20X5,the shareholders' equity of Havers Ltd was (amounts in thousands) : At the date of acquisition,the carrying amounts of the net assets of Havers Ltd approximated fair value.If a consolidated balance sheet were to be prepared for Helios Ltd and its subsidiaries at the date of acquisition,the consolidation adjustment to eliminate the investment in the subsidiary would be:

At the date of acquisition,the carrying amounts of the net assets of Havers Ltd approximated fair value.If a consolidated balance sheet were to be prepared for Helios Ltd and its subsidiaries at the date of acquisition,the consolidation adjustment to eliminate the investment in the subsidiary would be:

Definitions:

Fully Depreciated

An asset's state when it has amortized or written off its entire initial cost over its useful life, leaving it with a book value of zero or minimal value.

Asset

An asset is a resource with economic value that an individual, corporation, or country owns or controls with the expectation that it will provide future benefit.

Life Estimate

A projection or approximation of the duration or longevity of an entity, product, or component.

Financial Statements

Formal records of the financial activities and position of a business, person, or other entity.

Q2: Totals and subtotals in a consolidation worksheet

Q5: An immaterial segment is never disclosed despite

Q7: Under current accounting standards a company may

Q17: A Ltd controls B Ltd who in

Q33: (Appendix 5A)If the predetermined overhead rate is

Q33: Explain the following statement:<br>'When reconciling the investor's

Q33: The essential element that would distinguish a

Q40: At the level of sales for the

Q103: Dodero Company produces a single product that

Q114: A total of 30,000 units were sold