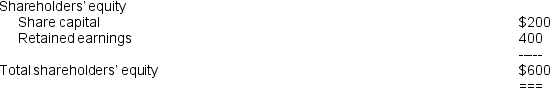

On July 1 20X5,Helios Ltd acquired all of the share capital of Havers Pty Ltd (100,000 shares) for $10 per share.Immediately subsequent to acquisition,the directors of Havers Ltd declared and paid a dividend of $60,000 from the retained earnings at June 30 20X5.During the year ended June 30 20X6,Helios Ltd received an interim dividend of $40,000 from Havers Ltd and the directors of Havers Ltd declared a final dividend of $60,000.At the date of acquisition,July 1 20X5,the shareholders' equity of Havers Ltd was (amounts in thousands) :  At the date of acquisition,the carrying amounts of the net assets of Havers Ltd approximated fair value.If a consolidated balance sheet were to be prepared for Helios Ltd and its subsidiaries at the date of acquisition,the consolidation adjustment to eliminate the investment in the subsidiary would be:

At the date of acquisition,the carrying amounts of the net assets of Havers Ltd approximated fair value.If a consolidated balance sheet were to be prepared for Helios Ltd and its subsidiaries at the date of acquisition,the consolidation adjustment to eliminate the investment in the subsidiary would be:

Definitions:

Product Costs

Costs that are directly associated with the manufacturing of goods, including materials, labor, and overhead.

Direct Materials Used

The actual amount of raw materials consumed in the production process of goods.

Work in Process Inventory

Inventory that includes all unfinished goods being manufactured at a given time.

Merchandise Inventory

Goods and products that a retailer, wholesaler, or distributor holds for the purpose of resale to customers.

Q13: On 30 September 20X7,Auction Ltd acquired a

Q27: In preparing a consolidated statement of cash

Q45: For internal uses,managers are more concerned with

Q57: Daffe Corporation uses direct labor-hours in

Q57: All costs incurred in a merchandising firm

Q62: What was the cost (in thousands of

Q73: If the fixed expenses of a

Q86: Scanlon Company has a job-order costing system

Q91: When completed goods are sold,the transaction is

Q100: Logan Products,a small manufacturer,has submitted the