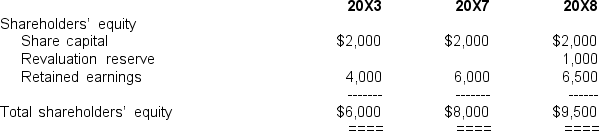

The following statements of shareholders' equity were prepared for Harnham Hill Ltd,a 20% owned associate of the parent entity Delville Wood Ltd,at June 30 (amounts in thousands) :  Other information:

Other information:

I.Delville Wood Ltd acquired its 20% investment on July 1 20X3 for a cash outlay of $2,000,000.

II.During the year ended June 30 20X8,Harnham Hill Ltd earned a profit of $1,400,000 before tax (income tax expense $400,000) and paid a dividend of $500,000.

III.At June 30 20X7,Delville Wood Ltd held inventories which had been supplied by Harnham Hill Ltd at a mark-up of $100,000.

IV.At June 30 20X8,a subsidiary of Delville Wood Ltd held inventories that had been supplied by Harnham Hill Ltd at a mark-up of $50,000.

V.During the year ended June 30 20X8,Delville Wood Ltd charged Harnham Hill Ltd with a management fee of $100,000 for administration services.

VI.In the income statement of Harnham Hill Ltd was interest revenue of $50,000 which had been earned on a loan made to a subsidiary of Delville Wood Ltd.

VII.The income tax rate was 30%.

VIII.Any goodwill element in the cost of the investment had not been impaired in the investment period.

At June 30 20X8,the carrying amount of the investment in the consolidated balance sheet of the group controlled by Delville Wood Ltd was:

Definitions:

Chronically Depressed

Experiencing depression or depressive symptoms persistently over an extended period.

Achievements

The successful completion of tasks or attainment of objectives, measured against known standards of excellence.

Unrealistic Optimism

The belief that positive outcomes are more likely than negative ones, often underestimating potential risks.

Norepinephrine

A neurotransmitter and hormone involved in the body's response to stress, increasing heart rate and blood pressure, among other functions.

Q5: The effect of all intragroup transactions must

Q6: The one-line method of accounting for joint

Q16: Discuss the concepts of 'shared control' and

Q20: Translation of financial statements into the presentation

Q20: On July 1 20X5,Helios Ltd acquired all

Q25: The carrying amount of property plant and

Q29: Which of the following factors indicate that

Q41: The declaration date of a dividend determines

Q43: Which of the following is not an

Q75: Last month,when 10,000 units of a product