The following data relate to Questions 18-22:

During the year ended June 30 20X7, Johnson Ltd became deeply involved in trade with Malaysia. On July 1 20X6, the company acquired 50% of the share capital of a Malaysian palm oil producer, Plantations Berhad, for $7,000,000. For the year ended June 30 20X7, the following balance sheet and income statement were prepared by Plantations Berhad (amounts in thousands) :

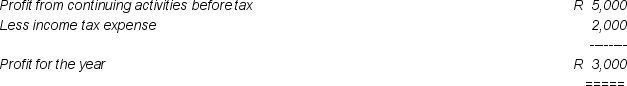

Income Statement for the Year ended June 30 20X7

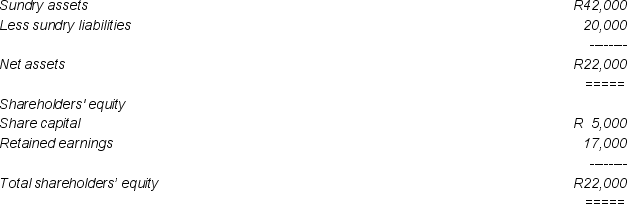

Balance Sheet as at June 30 20X7

Balance Sheet as at June 30 20X7

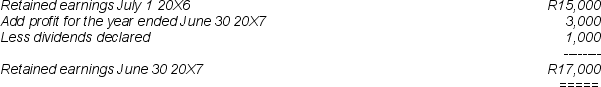

Statement of the Movement in Retained Earnings in the Year ended June 30 20X7

Statement of the Movement in Retained Earnings in the Year ended June 30 20X7

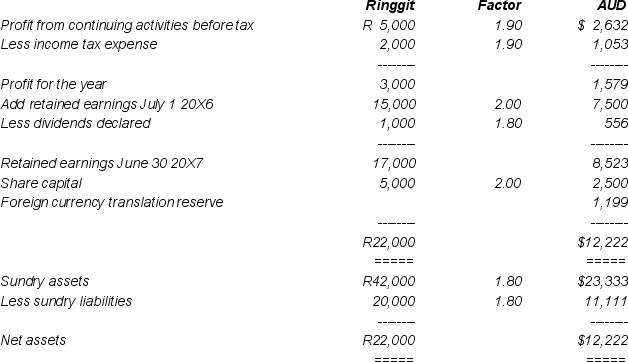

The functional currency of Plantations Berhad was Malaysian Ringgit. The following translation statement was prepared for the company (amounts in thousands) :

The functional currency of Plantations Berhad was Malaysian Ringgit. The following translation statement was prepared for the company (amounts in thousands) :

Additional information:

Additional information:

a) A deferred tax liability of 30% of the foreign currency translation reserve is to be recognised.

b) On July 1 20X6, as a partial hedge against its investment in Plantations Berhad, Johnson Ltd took out a three (3) year loan of R 8,000,000 from the Bank Negara at 12% interest, with interest payable quarterly commencing September 30 20X6.

c) On May 15 20X7 Johnson Ltd placed an order for R 2,000,000 in merchandise for resale from Malaysian Industries Berhad, payable in USD. The goods were shipped FOB on May 31 with settlement due on July 31 20X7.

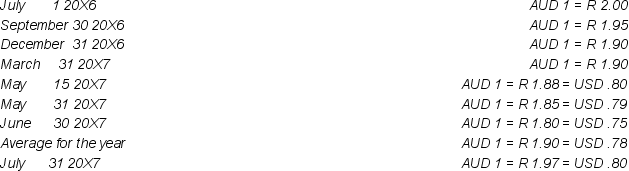

At relevant dates the exchange rates were:

-In the separate income statement of Johnson Ltd for the year ended June 30 20X7,the translation gain or loss arising on the loan from the Bank Negara was (rounded to the nearest thousand dollars) :

Definitions:

Mathematical Ability

The capacity to understand, manipulate, and use numbers and mathematical concepts effectively.

Social Skills

The abilities used to communicate, interact, and build relationships with others effectively.

Adverse Impact

A concept in employment law referring to employment practices that appear neutral but have a discriminatory effect on a protected group.

Disparate Treatment

A form of discrimination in which individuals are treated differently based on prohibited factors such as race, age, or gender.

Q5: When the functional currency of a foreign

Q9: A segment which does not reach any

Q12: All consolidation adjusting entries must be repeated

Q13: For a company to be required to

Q15: The one-line method of accounting for joint

Q16: Product harming customers is NOT a business

Q16: Unrealised profits or losses on the transfer

Q21: Under current accounting standards,companies are required to

Q27: The ownership interests in a group which

Q31: Under the current rate method foreign exchange,differences