The following data relate to Questions 18-22:

During the year ended June 30 20X7, Johnson Ltd became deeply involved in trade with Malaysia. On July 1 20X6, the company acquired 50% of the share capital of a Malaysian palm oil producer, Plantations Berhad, for $7,000,000. For the year ended June 30 20X7, the following balance sheet and income statement were prepared by Plantations Berhad (amounts in thousands) :

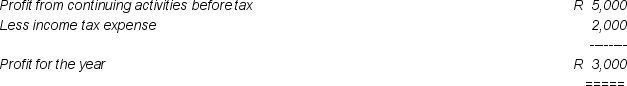

Income Statement for the Year ended June 30 20X7

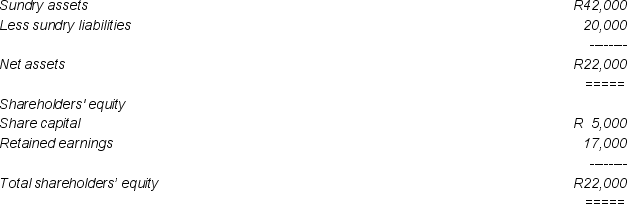

Balance Sheet as at June 30 20X7

Balance Sheet as at June 30 20X7

Statement of the Movement in Retained Earnings in the Year ended June 30 20X7

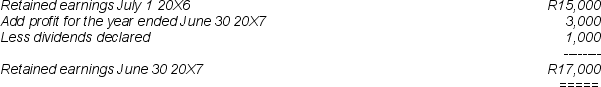

Statement of the Movement in Retained Earnings in the Year ended June 30 20X7

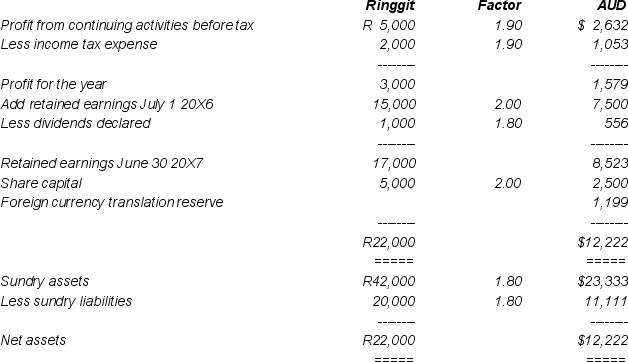

The functional currency of Plantations Berhad was Malaysian Ringgit. The following translation statement was prepared for the company (amounts in thousands) :

The functional currency of Plantations Berhad was Malaysian Ringgit. The following translation statement was prepared for the company (amounts in thousands) :

Additional information:

Additional information:

a) A deferred tax liability of 30% of the foreign currency translation reserve is to be recognised.

b) On July 1 20X6, as a partial hedge against its investment in Plantations Berhad, Johnson Ltd took out a three (3) year loan of R 8,000,000 from the Bank Negara at 12% interest, with interest payable quarterly commencing September 30 20X6.

c) On May 15 20X7 Johnson Ltd placed an order for R 2,000,000 in merchandise for resale from Malaysian Industries Berhad, payable in USD. The goods were shipped FOB on May 31 with settlement due on July 31 20X7.

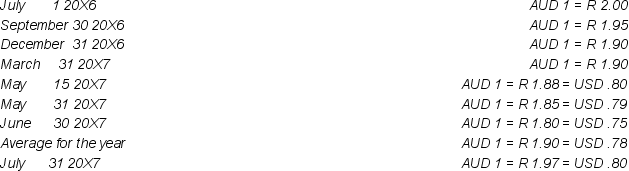

At relevant dates the exchange rates were:

-The transaction involving the purchase of the merchandise inventory from Malaysian Industries Berhad is:

Definitions:

Output Combination

An output combination refers to the mixture of different goods and/or services produced by an economy or firm within a certain period, highlighting the diversity in production.

Human Capital

The collective skills, knowledge, or other intangible assets of individuals that can be used to create economic value for the individuals, their employers, or the community.

Labor Productivity

The measure of economic output per unit of input, typically calculated as total output divided by the number of hours worked.

Rules Of The Game

The laws, customs, manners, conventions, and other institutional elements that determine transaction costs and thereby affect people’s incentive to undertake production and exchange.

Q4: A loss arising from an intragroup transfer

Q8: The investment date and the acquisition date

Q12: All consolidation adjusting entries must be repeated

Q13: Explain the consequences of distinguishing between pre-acquisition

Q18: The parent interest (PI)in equity will be

Q19: The classification of an item as a

Q24: Post-acquisition changes in the composition of pre-acquisition

Q26: If total costs are $20,000 at an

Q31: Under the fair value (100% of

Q45: Refer to the table above.Management is contemplating