The following data relate to Questions 18-22:

During the year ended June 30 20X7, Johnson Ltd became deeply involved in trade with Malaysia. On July 1 20X6, the company acquired 50% of the share capital of a Malaysian palm oil producer, Plantations Berhad, for $7,000,000. For the year ended June 30 20X7, the following balance sheet and income statement were prepared by Plantations Berhad (amounts in thousands) :

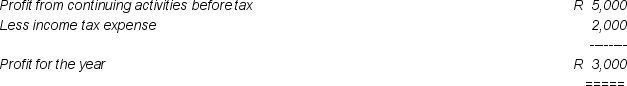

Income Statement for the Year ended June 30 20X7

Balance Sheet as at June 30 20X7

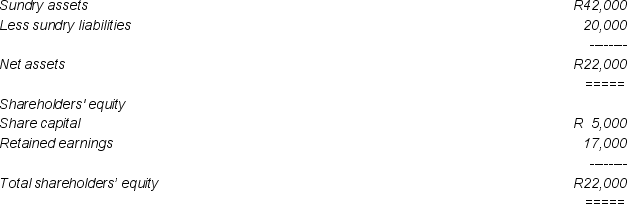

Balance Sheet as at June 30 20X7

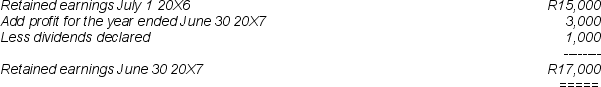

Statement of the Movement in Retained Earnings in the Year ended June 30 20X7

Statement of the Movement in Retained Earnings in the Year ended June 30 20X7

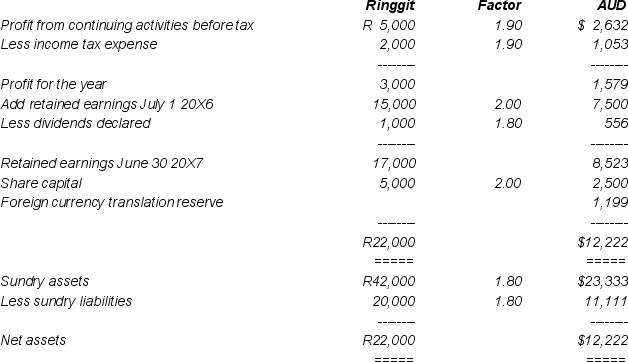

The functional currency of Plantations Berhad was Malaysian Ringgit. The following translation statement was prepared for the company (amounts in thousands) :

The functional currency of Plantations Berhad was Malaysian Ringgit. The following translation statement was prepared for the company (amounts in thousands) :

Additional information:

Additional information:

a) A deferred tax liability of 30% of the foreign currency translation reserve is to be recognised.

b) On July 1 20X6, as a partial hedge against its investment in Plantations Berhad, Johnson Ltd took out a three (3) year loan of R 8,000,000 from the Bank Negara at 12% interest, with interest payable quarterly commencing September 30 20X6.

c) On May 15 20X7 Johnson Ltd placed an order for R 2,000,000 in merchandise for resale from Malaysian Industries Berhad, payable in USD. The goods were shipped FOB on May 31 with settlement due on July 31 20X7.

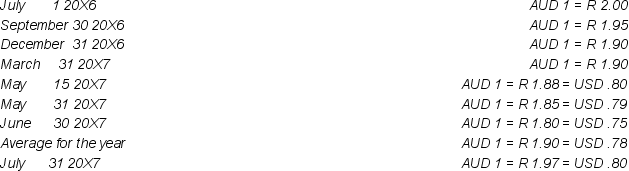

At relevant dates the exchange rates were:

-In the consolidated balance sheet at June 30 20X7 of the group controlled by Johnson Ltd,the foreign currency translation reserve attributable to the members the parent entity would be (rounded to the nearest thousand dollars) :

Definitions:

Q3: Revaluation of an acquiree's assets in a

Q13: The journal entry to record the initial

Q14: For the majority of manufacturing companies,the distinction

Q17: Explain why the existence of goodwill enables

Q20: In the reporting of segment revenue data:<br>A)

Q22: A gain on bargain purchase will be

Q32: On a profit-volume chart,the output where the

Q37: In preparing a consolidated financial report,the parent

Q41: Which items are listed first on a

Q51: L Ltd can subcontract out one of