The following data relate to Questions 18-22:

During the year ended June 30 20X7, Johnson Ltd became deeply involved in trade with Malaysia. On July 1 20X6, the company acquired 50% of the share capital of a Malaysian palm oil producer, Plantations Berhad, for $7,000,000. For the year ended June 30 20X7, the following balance sheet and income statement were prepared by Plantations Berhad (amounts in thousands) :

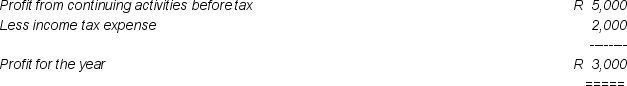

Income Statement for the Year ended June 30 20X7

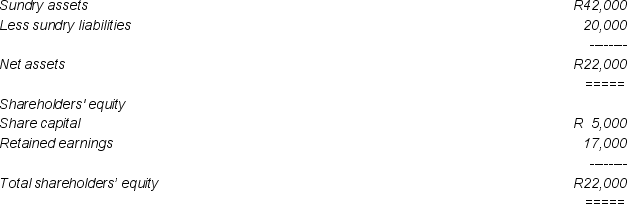

Balance Sheet as at June 30 20X7

Balance Sheet as at June 30 20X7

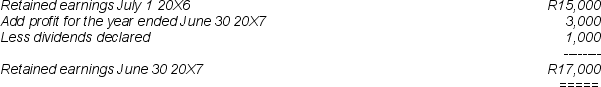

Statement of the Movement in Retained Earnings in the Year ended June 30 20X7

Statement of the Movement in Retained Earnings in the Year ended June 30 20X7

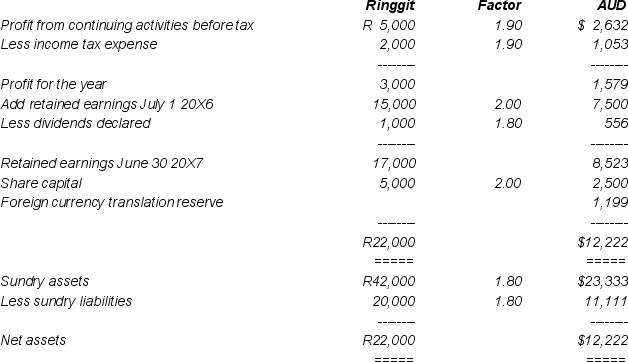

The functional currency of Plantations Berhad was Malaysian Ringgit. The following translation statement was prepared for the company (amounts in thousands) :

The functional currency of Plantations Berhad was Malaysian Ringgit. The following translation statement was prepared for the company (amounts in thousands) :

Additional information:

Additional information:

a) A deferred tax liability of 30% of the foreign currency translation reserve is to be recognised.

b) On July 1 20X6, as a partial hedge against its investment in Plantations Berhad, Johnson Ltd took out a three (3) year loan of R 8,000,000 from the Bank Negara at 12% interest, with interest payable quarterly commencing September 30 20X6.

c) On May 15 20X7 Johnson Ltd placed an order for R 2,000,000 in merchandise for resale from Malaysian Industries Berhad, payable in USD. The goods were shipped FOB on May 31 with settlement due on July 31 20X7.

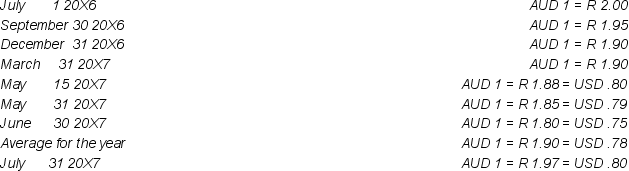

At relevant dates the exchange rates were:

-In the separate income statement of Johnson Ltd for the year ended June 30 20X7,the translation gain or loss arising on the loan from the Bank Negara was (rounded to the nearest thousand dollars) :

Definitions:

Compute

To calculate or process information by performing mathematical operations, often using a computer.

Unbiased Estimates

Statistical estimates that are expected to be equal to the true value of the parameter being measured, not systematically over or underestimating the true value.

Conservative Estimates

Predictions or calculations that are deliberately cautious or understated, often to ensure that outcomes will meet or exceed expectations.

Strengths

Aspects of an entity, be it an individual, team, project, or system, that represent positive attributes or competitive advantages.

Q1: Under the temporal method,all revenue and expense

Q2: As part of the consolidation process,any unrealised

Q3: Discuss the objectives of translation of financial

Q14: Explain the basis on which adjustments to

Q20: AASB 107 requires the use of the

Q28: The term 'foreign currency transaction' refers to

Q33: Mary Tappin,an assistant Vice President at Galaxy

Q33: In accounting for a reverse acquisition it

Q41: Investor Ltd holds 25% of the voting

Q52: An example of a semi-fixed (semi-variable)cost is:<br>A)