The following data relate to Questions 18-22:

During the year ended June 30 20X7, Johnson Ltd became deeply involved in trade with Malaysia. On July 1 20X6, the company acquired 50% of the share capital of a Malaysian palm oil producer, Plantations Berhad, for $7,000,000. For the year ended June 30 20X7, the following balance sheet and income statement were prepared by Plantations Berhad (amounts in thousands) :

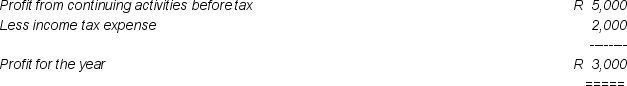

Income Statement for the Year ended June 30 20X7

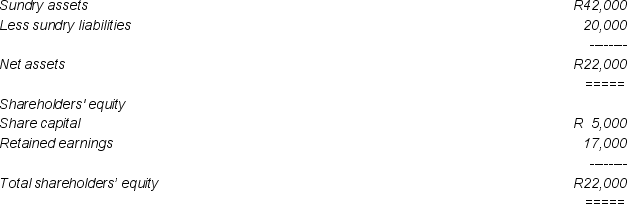

Balance Sheet as at June 30 20X7

Balance Sheet as at June 30 20X7

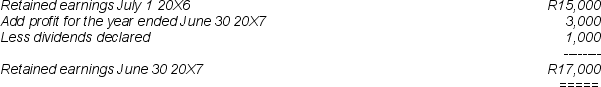

Statement of the Movement in Retained Earnings in the Year ended June 30 20X7

Statement of the Movement in Retained Earnings in the Year ended June 30 20X7

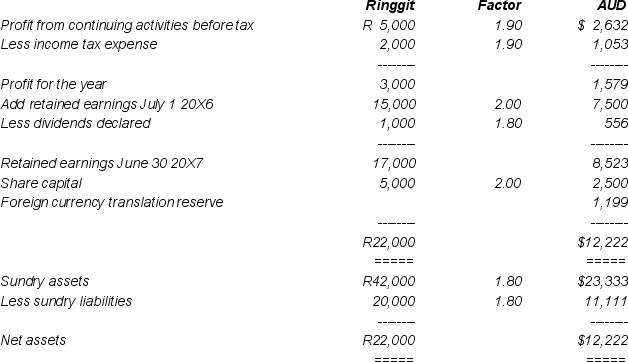

The functional currency of Plantations Berhad was Malaysian Ringgit. The following translation statement was prepared for the company (amounts in thousands) :

The functional currency of Plantations Berhad was Malaysian Ringgit. The following translation statement was prepared for the company (amounts in thousands) :

Additional information:

Additional information:

a) A deferred tax liability of 30% of the foreign currency translation reserve is to be recognised.

b) On July 1 20X6, as a partial hedge against its investment in Plantations Berhad, Johnson Ltd took out a three (3) year loan of R 8,000,000 from the Bank Negara at 12% interest, with interest payable quarterly commencing September 30 20X6.

c) On May 15 20X7 Johnson Ltd placed an order for R 2,000,000 in merchandise for resale from Malaysian Industries Berhad, payable in USD. The goods were shipped FOB on May 31 with settlement due on July 31 20X7.

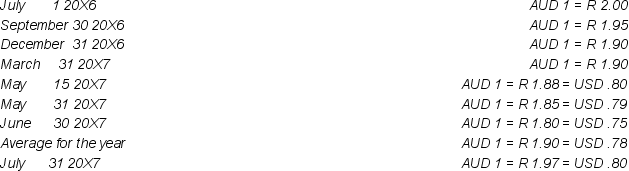

At relevant dates the exchange rates were:

-At June 30 20X7 Johnson Ltd recognised its equity in the dividends declared by Plantations Berhad in its income statement.When the dividend was subsequently received from Plantations Berhad,the exchange rate was AUD 1 = R 1.78.The exchange gain or loss recognised by Johnson Ltd on receiving that dividend was (rounded to the nearest dollar)

Definitions:

Statistics

Statistics is the branch of mathematics dealing with the collection, analysis, interpretation, and presentation of masses of numerical data.

Sample Size

Sample size refers to the number of observations or individuals included in a statistical sample.

Null Hypothesis

A hypothesis that assumes no significant difference or relationship exists between certain variables; it's the default assumption to be tested against.

Research Hypothesis

A statement made by a researcher that predicts a relationship between two or more variables.

Q8: A company has total sales revenue of

Q13: Goodwill is not an identifiable intangible asset

Q18: The main advantage of the one line

Q19: Unrealised profits on intra-group sale of inventories

Q21: The lean approach results in fewer defects,less

Q22: Break-even point is represented graphically as:<br>A) the

Q26: Translation of financial statements of foreign operations

Q30: If total costs are $80,000 at an

Q35: A Ltd sells inventory to its parent

Q38: The following inventory valuation errors were