The following data relate to Questions 18-22:

During the year ended June 30 20X7, Johnson Ltd became deeply involved in trade with Malaysia. On July 1 20X6, the company acquired 50% of the share capital of a Malaysian palm oil producer, Plantations Berhad, for $7,000,000. For the year ended June 30 20X7, the following balance sheet and income statement were prepared by Plantations Berhad (amounts in thousands) :

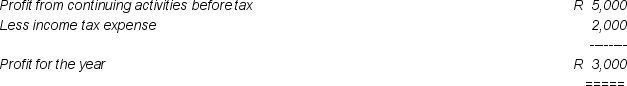

Income Statement for the Year ended June 30 20X7

Balance Sheet as at June 30 20X7

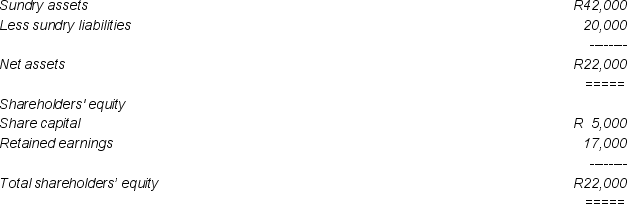

Balance Sheet as at June 30 20X7

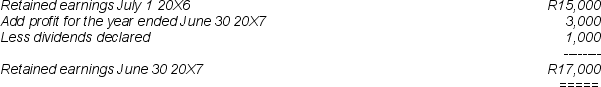

Statement of the Movement in Retained Earnings in the Year ended June 30 20X7

Statement of the Movement in Retained Earnings in the Year ended June 30 20X7

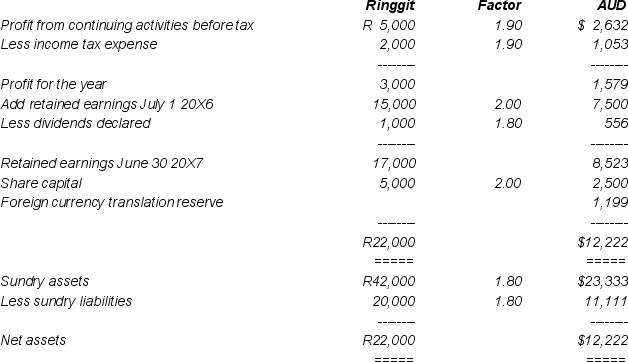

The functional currency of Plantations Berhad was Malaysian Ringgit. The following translation statement was prepared for the company (amounts in thousands) :

The functional currency of Plantations Berhad was Malaysian Ringgit. The following translation statement was prepared for the company (amounts in thousands) :

Additional information:

Additional information:

a) A deferred tax liability of 30% of the foreign currency translation reserve is to be recognised.

b) On July 1 20X6, as a partial hedge against its investment in Plantations Berhad, Johnson Ltd took out a three (3) year loan of R 8,000,000 from the Bank Negara at 12% interest, with interest payable quarterly commencing September 30 20X6.

c) On May 15 20X7 Johnson Ltd placed an order for R 2,000,000 in merchandise for resale from Malaysian Industries Berhad, payable in USD. The goods were shipped FOB on May 31 with settlement due on July 31 20X7.

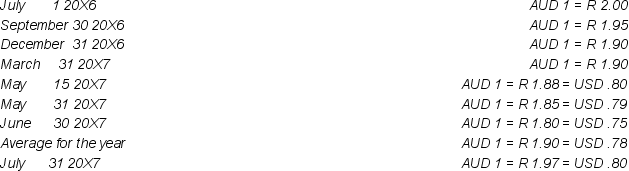

At relevant dates the exchange rates were:

-The transaction involving the purchase of the merchandise inventory from Malaysian Industries Berhad is:

Definitions:

Ending Inventory

The total value of all products, goods, and materials in stock at the end of an accounting period.

Interim Financial Statements

Financial reports covering a period of less than a full fiscal year, often quarterly.

Full Disclosure

A principle requiring that all material facts and information related to financial transactions be disclosed in financial statements.

Conservatism Principle

An accounting principle that advises reporting expenses and liabilities as soon as possible, but revenue only when it is ensured.

Q3: The shareholders' interest in a subsidiary that

Q8: The investment date and the acquisition date

Q9: In a manufacturing company,goods available for sale

Q10: Cash flows from operating activities can be

Q13: The holding of 20% or more of

Q23: One of the advantages of forming a

Q34: A dividend paid by a subsidiary out

Q36: Investors that are not parent entities must

Q36: Day-to-day decision making is most common to

Q65: Contribution per unit is best described as:<br>A)