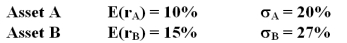

Two assets have the following expected returns and standard deviations when the risk-free rate is 5%:  An investor with a risk aversion of A = 3 would find that _________________ on a risk return basis.

An investor with a risk aversion of A = 3 would find that _________________ on a risk return basis.

Definitions:

Realistic Job Preview

An accurate presentation of the potential duties and responsibilities of a job role to candidates, aimed at reducing turnover by setting proper expectations.

Uncertainty Reduction

The process through which individuals, groups, or organizations gather information to decrease the level of uncertainty about future events or behaviors.

Job Satisfaction

The level of contentment or happiness an individual feels towards their job role, considering aspects such as work environment and compensation.

Psychological Contract

An unwritten agreement that exists between an employer and employees, outlining mutual expectations including attitudes, behaviors, and contributions.

Q11: The tendency of investors to hold on

Q13: Even though indexing is growing in popularity

Q14: Cumulative Breadth for the four days is

Q23: A gardener wants to build a circular

Q35: You are considering investing in a no

Q52: A 4500-kg truck traveling due east at

Q55: The market collapse of 1987 prompted _.<br>A)

Q64: If enough investors decide to purchase stocks

Q71: Investing in two assets with a correlation

Q75: Assume that a company announces unexpectedly high