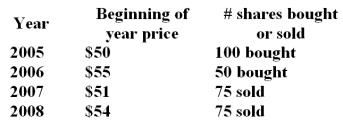

You have the following rates of return for a risky portfolio for several recent years. Assume that the stock pays no dividends

-What is the geometric average return for the period?

Definitions:

Flexible Budget

A dynamic budget that changes according to the business activity levels, offering a more adaptable financial planning tool.

Level of Activity

A measure of the volume of production or operations, often influencing cost behavior and used to allocate fixed costs to units of product.

Revenue Variance

The difference between the actual revenue earned and the budgeted or expected revenue.

Static Planning Budget

A budget based on a single level of output, not adjusted for changes in activity levels.

Q4: Investors who wish to liquidate their holdings

Q6: A portfolio with a 25% standard deviation

Q22: Consider the single factor APT.Portfolio A has

Q30: Which of the following is not a

Q31: Bonds with coupon rates that fall when

Q39: Consider the liquidity preference theory of the

Q42: Which of the following firms was not

Q54: Which one of the following would be

Q63: You pay $21,600 to the Laramie Fund

Q86: If the utility you derive from your