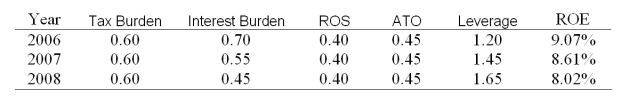

Look at the following table of data for Key Biscuit Company:  What must have caused the firm's ROE to drop?

What must have caused the firm's ROE to drop?

Definitions:

Taxable Amounts

The portions of income, estate, or transactions subject to tax, according to applicable tax laws.

Deferred Tax Liabilities

Future tax payments resulting from temporary differences between the book value and the tax basis of assets and liabilities.

Deferred Tax Assets

Future tax benefits arising from temporary differences between the tax and accounting recognition of revenue and expenses.

Classifying

The process of organizing data, objects, or concepts into categories based on shared qualities or characteristics.

Q11: Which one of the following is equal

Q21: Characteristics _ would be typical of an

Q25: Which one of the following is probably

Q27: The volume of interest rate swaps increased

Q28: Trend analysts that follow bonds are most

Q37: An American call option gives the buyer

Q40: A portfolio generates an annual return of

Q63: The yield to maturity of an 10-year

Q68: A bond has a par value of

Q78: A managed portfolio has a standard deviation