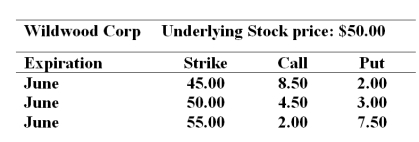

You are cautiously bullish on the common stock of the Wildwood Corporation over the next several months. The current price of the stock is $50 per share. You want to establish a bullish money spread to help limit the cost of your option position. You find the following option quotes:

-To establish a bull money spread with calls you would _______________.

Definitions:

Payoff Table

A table showing the possible outcomes or gains for different decisions or strategies under various conditions.

Opportunity Loss Table

A tabular representation used in decision making to outline the potential losses for not choosing the best alternative.

Expected Monetary Value

A statistical technique used to calculate the average outcome when the future includes scenarios that may or may not happen.

Dishwasher Designs

Various structural and functional configurations of dishwashers, including capacity, layout, and technology, to meet specific user needs or preferences.

Q25: Morningstar's RAR produce results which are similar

Q30: Forward contracts _ traded on an organized

Q54: The appraisal ratio is equal to the

Q58: A firm is planning on paying its

Q65: A firm cuts its dividend payout ratio.As

Q69: A 1% decline in yield will have

Q75: Assuming semiannual compounding,a 20-year zero coupon bond

Q78: What portfolio position in stock and T-Bills

Q78: A managed portfolio has a standard deviation

Q83: A firm's earnings per share increased from