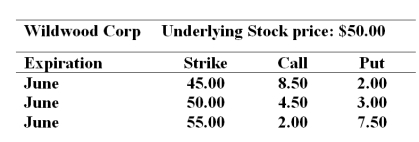

You are cautiously bullish on the common stock of the Wildwood Corporation over the next several months. The current price of the stock is $50 per share. You want to establish a bullish money spread to help limit the cost of your option position. You find the following option quotes:

-Ignoring commissions,the cost to establish the bull money spread with calls would be _______.

Definitions:

Stoicism

An ancient philosophy emphasizing rationality and self-control, teaching that virtue is sufficient for happiness and one should not be controlled by the desire for pleasure or fear of pain.

Ethical Egoism

A moral philosophy that posits individuals should act in their own self-interest because it is the moral thing to do.

Analysis

The process of examining components or structures of a subject to understand its nature or to determine its essential features and their relations.

Hedonism

A philosophy that argues pleasure or happiness is the highest good and ultimate aim in life.

Q5: The _ of a bond is computed

Q16: A hypothetical futures contract on a non-dividend-paying

Q20: According to the liquidity preference theory of

Q26: Refer to the financial statements of Flathead

Q35: The S&P500 index futures contract is an

Q49: Convexity of a bond is _.<br>A) the

Q50: Quick ratio is a measure of firm's

Q64: The percentage change in the stock call

Q70: The September 14,2009 price quotation for a

Q81: If the maturity of a bank's assets