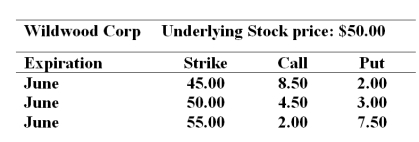

You are cautiously bullish on the common stock of the Wildwood Corporation over the next several months. The current price of the stock is $50 per share. You want to establish a bullish money spread to help limit the cost of your option position. You find the following option quotes:

-If in June the stock price is $53 your net profit on the bull money spread would be ________.

Definitions:

Pollution Abatement

The reduction or elimination of pollutants released into the environment, often through regulatory policies or technology changes.

Pigouvian Tax

A tax imposed on activities that generate negative externalities, aiming to correct an inefficient market outcome by increasing the cost to include the external costs.

CFCs

Chlorofluorocarbons; chemical compounds used in aerosol sprays and refrigerants that have been found to deplete the ozone layer.

Adverse Selection

A situation in which one party in a transaction has more information than the other, often leading to the selection of poorer-quality goods or higher-risk individuals.

Q6: Everything else equal the _ the maturity

Q6: In the Treynor-Black model security analysts _.<br>A)

Q25: If you wish to tilt your savings

Q28: At year end,taxes on a futures position

Q39: The yen per dollar spot rate is

Q52: A _ is an option valuation model

Q67: A bond has a current price of

Q69: A 1% decline in yield will have

Q75: Warrants differ from listed options in that

Q83: Which of the following affects a firm's