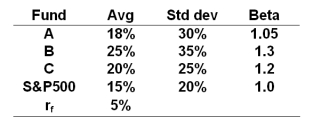

The risk free rate, average returns, standard deviations and betas for three funds and the S&P500 are given below.

-If these portfolios are subcomponents which make up part of a well diversified portfolio then portfolio ______ is preferred.

Definitions:

APA

The American Psychological Association, a leading scientific and professional organization representing psychology in the United States.

Research Using Animals

The scientific study involving non-human animals as subjects to gain insights into biological, psychological, and medical questions.

Independent Variable

In experimental and statistical research, the variable that is manipulated or changed to observe its effect on a dependent variable.

Socioeconomic Class

A categorization of individuals or families based on factors such as income, occupation, and education, reflecting their economic and social position.

Q13: Hedging this portfolio by selling S&P 500

Q15: What was the annual return on this

Q16: The hedge ratio is often called the

Q18: The stock price of Bravo Corp.is currently

Q37: Research suggests that the performance of the

Q49: An investor purchases a long call at

Q56: Investor A bought a call option that

Q64: The percentage change in the stock call

Q80: You own a stock portfolio worth $50,000.You

Q105: Sam and Lele are in their late