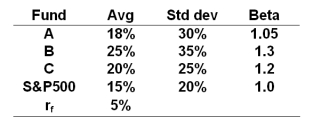

The risk free rate, average returns, standard deviations and betas for three funds and the S&P500 are given below.

-Based on the M2 measure,portfolio C has a superior return of _____ as compared to the S&P500.

Definitions:

Reseller Market

A market segment where businesses purchase products with the intention of selling them to end consumers without significant modification.

Retailers

Businesses or individuals that sell goods directly to consumers for personal use, rather than for resale or wholesale.

Wholesalers

Entities engaged in selling goods in large quantities to retailers, other merchants, or industrial, institutional, and commercial users.

North American Industry Classification System

A classification system that categorizes businesses into detailed sectors and industries, primarily to facilitate economic data analysis and reporting.

Q7: Refer to the financial statements of Burnaby

Q14: The quoted interest rate on a 3

Q24: Which stock market has the largest weight

Q27: Annie's Donut Shops,Inc.has expected earnings of $3.00

Q29: What was the manager's return in the

Q30: A hedge ratio of 0.70 implies that

Q39: How much money will Sharon have in

Q48: Which of the following strategies makes a

Q62: Medfield College's $10 million endowment fund is

Q67: The nominal interest rate is 6%.The inflation