Multiple Choice

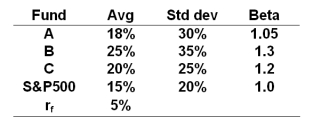

The risk free rate, average returns, standard deviations and betas for three funds and the S&P500 are given below.

-Which one of the following is largely based on forecasts of macroeconomic factors?

Definitions:

Related Questions

Q1: A "bet" option is also called a

Q18: You want to minimize your current tax

Q27: A longer time to maturity will unambiguously

Q49: Which of the following is the rate

Q59: The Consumer Price Index (CPI)is the amount

Q68: If the S&P 500 index futures contract

Q73: A preferred share of Coquihalla Corporation will

Q76: A hypothetical futures contract on a non-dividend-paying

Q82: At what price would you expect ART

Q85: It is very hard to statistically verify