Multiple Choice

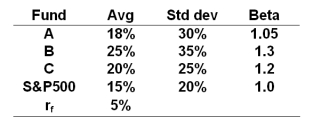

The risk free rate, average returns, standard deviations and betas for three funds and the S&P500 are given below.

-Based on the example used in the book,a perfect market timer would have made _______ of dollars on a $1 investment between 1926 and 2008.

Definitions:

Related Questions

Q15: Firm B produce gadgets.The price of gadgets

Q24: The fastest growing category of hedge funds

Q54: [Vacations | Education] would be considered a

Q56: The Consumer Price Index is a measure

Q64: Suppose you purchase one Texas Instruments August

Q65: The Average Indexed Monthly Income is used

Q70: As you get older you decide to

Q76: Insurance provides a way to make money

Q84: A supply side economist would likely agree

Q117: Utility refers to the amount of satisfaction