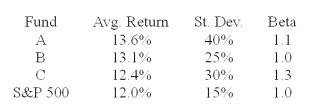

The average returns, standard deviations and betas for three funds are given below along with data for the S&P 500 index. The risk free return during the sample period is 6%.

-You wish to evaluate the three mutual funds using the Treynor measure for performance evaluation.The fund with the highest Treynor measure of performance is __________.

Definitions:

Conceptual Framework

An underlying structure in accounting that guides the development of standards and the preparation of financial statements.

Equity

The value of an owner's interest in a property, minus the liabilities tied to the property.

Independent

Free from external control or influence; not depending on another's authority.

Historical Cost

An accounting principle requiring assets to be recorded at their original cost at the time of purchase, without adjustments for inflation or market value changes.

Q5: Hedge funds report average returns in December

Q7: Refer to the financial statements of Burnaby

Q11: Advantages of exchange traded options over OTC

Q22: If you combine a long stock position

Q29: After Monday's close the balance on your

Q39: You write one IBM July 120 call

Q53: In a private defined benefit pension plan

Q53: A pension fund will owe $10 million

Q66: For an investor concerned with maximizing liquidity,which

Q73: A portfolio generates an annual return of