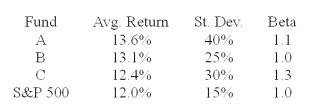

The average returns, standard deviations and betas for three funds are given below along with data for the S&P 500 index. The risk free return during the sample period is 6%.

-You wish to evaluate the three mutual funds using the Jensen measure for performance evaluation.The fund with the highest Jensen measure of performance is __________.

Definitions:

Variable Cost

Expenses that vary in relation to the amount of product or service generated by a company.

Sales Price

The final amount of money charged for a product or service, or the value that consumers are willing to pay.

Optimal Point

The most favorable position or condition that yields the maximum benefit or efficiency in a given situation, such as in investment or production.

Credit Policy

Rules a business adheres to for assessing a customer's eligibility for credit and the stipulations under which it is offered.

Q10: The solvency of Social Security is threatened

Q25: Hedge funds can invest in various investment

Q25: The financial crisis of 2008 and 2009

Q32: A firm has current assets which could

Q43: Suppose you write a strap and the

Q55: Go Global Investment Management has an asset

Q64: A portfolio manager indexes part of a

Q68: Refer to the financial statements of Flathead

Q72: What combination of variables is likely to

Q120: [GDP | CPI] is the total of