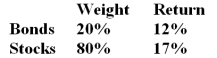

In a particular year, Salmon Arm Mutual Fund earned a return of 16% by making the following investments in asset classes:  The return on a bogey portfolio was 12% calculated as follows:

The return on a bogey portfolio was 12% calculated as follows:

-The total excess return on the managed portfolio was __________.

Definitions:

Variable Costing

A costing method that includes only variable manufacturing costs—direct materials, direct labor, and variable manufacturing overhead—in the cost of a unit of product.

Contribution Margin

The difference between sales revenue and variable costs, used to cover fixed costs and generate profit.

Variable Costing

A costing method that only includes variable costs (direct materials, direct labor, and variable manufacturing overhead) in product costs, while fixed costs are expensed in the period they are incurred.

Absorption Costing

An accounting method that includes both variable and fixed manufacturing overhead costs in the cost of a unit of product.

Q2: Saving for a child's education is an

Q4: You invest in various broadly diversified international

Q5: For a bank,the difference between the interest

Q6: In the Treynor-Black model security analysts _.<br>A)

Q6: A speculator will often prefer to buy

Q13: Westsyde Tool Company is expected to pay

Q33: A good financial plan completed when one

Q45: Assume there is a fixed exchange rate

Q58: The amount of risk an individual should

Q74: Government places controls on the personal financial