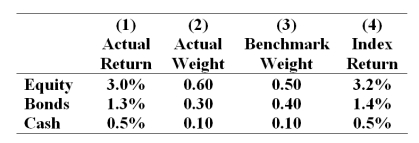

The table presents the actual return of each sector of the manager's portfolio in column (1) , the fraction of the portfolio allocated to each sector in column (2) , the benchmark or neutral sector allocations in column (3) , and the returns of sector indexes in column 4.

-What was the manager's return in the month?

Definitions:

Amenorrhea

The absence of menstruation in someone of reproductive age under conditions expected for menstruation.

Parotid Swelling

Inflammation or enlargement of the parotid glands, the largest of the salivary glands, which can be due to infection, blockage, or other medical conditions.

Lanugo

Fine, soft hair that covers the body and limbs of a fetus or newborn, which is usually shed before or shortly after birth.

Rigidity, Perfectionism

A tendency to be extremely strict and demanding of oneself, aiming for flawlessness in all aspects of life.

Q1: Research conducted by Rubinstein (1994)suggests that _

Q2: You own $75,000 worth of stock and

Q7: A mutual fund may not hold more

Q23: Your sister,an avid outdoors person,works in the

Q29: After Monday's close the balance on your

Q34: Typical initial investment in a hedge fund

Q39: A personal computer could not be used

Q54: The term quality of earnings refers to

Q67: Consider the theory of active portfolio management.Stocks

Q77: A portfolio generates an annual return of