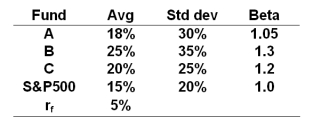

The risk free rate, average returns, standard deviations and betas for three funds and the S&P500 are given below.

-What is the T2 measure for portfolio A?

Definitions:

Neurology

The branch of medicine that deals with the study and treatment of disorders of the nervous system.

Disorders

Conditions that disrupt normal functions of the body or mind, leading to symptoms that affect health, wellness, and quality of life.

Female Reproductive Tract

The system of organs within a female that are involved in producing offspring, including the ovaries, fallopian tubes, uterus, and vagina.

Gynecology

The branch of medicine that focuses on women's health, especially the diagnosis and treatment of disorders affecting the female reproductive system.

Q5: On January 1,you sold one April S&P

Q9: Refer to the financial statements of Flathead

Q17: If the economy is going into a

Q23: If a firm has a positive tax

Q32: Which of the following are characteristics of

Q46: Synthetic stock positions are commonly used by

Q47: What was the manager's over or under

Q50: Convertible arbitrage hedge funds _.<br>A) attempt to

Q77: Probably the most active forward market is

Q82: Futures markets are regulated by the _.<br>A)