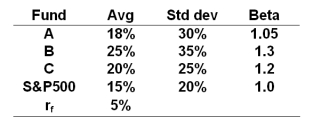

The risk free rate, average returns, standard deviations and betas for three funds and the S&P500 are given below.

-What is the M2 measure for portfolio B?

Definitions:

Bad Debt Expense

The expense recognized when receivables are no longer collectible, reflecting estimated losses from extending credit.

Percentage Rate

A proportion, often expressed as a percent, used to determine the interest to be charged or paid on a financial instrument or the growth rate of an investment.

Reported Earnings

The income stated in a company's financial statements, reflecting the company's performance over a specified period, typically a fiscal quarter or year.

Contra-Asset Account

A contra-asset account is an account used in a company's balance sheet to offset the balance of an associated asset account, reducing the net amount of both accounts.

Q10: When a short-selling hedge fund advertises in

Q21: Low interest rates after 2008 and 2009

Q24: The possibility that you are too conservative

Q26: All else equal call option values are

Q48: A firm purchases goods on credit worth

Q56: A company with an expected earnings growth

Q67: After one year,the exchange rate is unchanged

Q74: The arbitrage profit implied by these prices

Q80: The federal government's [fiscal | monetary] policy

Q102: The need for financial planning declines as