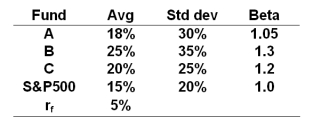

The risk free rate, average returns, standard deviations and betas for three funds and the S&P500 are given below.

-Based on the M2 measure,portfolio C has a superior return of _____ as compared to the S&P500.

Definitions:

Modernization Theory

Holds that economic underdevelopment results from poor countries lacking Western attributes, including Western values, business practices, levels of investment capital, and stable governments.

Development Theory

An extensive category of theories that seek to explain the processes, strategies, and mechanisms by which societies progress economically, socially, and politically.

Global Spending Priorities

The allocation and distribution of financial resources across various sectors globally, influenced by economic policies, societal needs, and international agreements.

Collectivism

A value system that emphasizes the importance of the group over individual achievements, promoting shared goals and responsibilities within a community.

Q3: An investor would want to _ to

Q16: An importer of televisions from Japan has

Q17: To _ means to mitigate a financial

Q26: Initial margin is usually set in the

Q33: Pharmaceuticals,food,and other necessities would be good performers

Q45: Suppose the desired put options with X

Q50: The M<sup>2</sup> measure of portfolio performance was

Q55: You believe that the spread between the

Q70: You own a $15 million bond portfolio

Q115: Inflation generally has little effect on personal