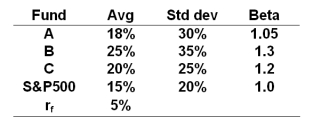

The risk free rate, average returns, standard deviations and betas for three funds and the S&P500 are given below.

-Based on the example used in the book,a perfect market timer would have made _______ of dollars on a $1 investment between 1926 and 2008.

Definitions:

Hypothesis

A proposed explanation made on the basis of limited evidence as a starting point for further investigation.

Scientific Method

A systematic methodology for investigating phenomena, acquiring new knowledge, or correcting and integrating previous knowledge based on empirical or measurable evidence subject to specific principles of reasoning.

Statistics

The science of collecting, analyzing, interpreting, and presenting empirical data to make informed decisions and predict outcomes.

Numerical Data

Data that consists of numbers, and can be quantified to perform mathematical calculations and statistical analysis.

Q2: Generally speaking the higher a firm's ROA

Q22: The one-year oil futures price should be

Q36: All else the same,an _ style option

Q41: The tax burden of the firm is

Q41: The financial crisis of 2008 and 2009

Q43: A call option with several months until

Q67: Personal financial management is important because it<br>A)controls

Q80: Portfolio performance is often decomposed into various

Q91: "1 want to accumulate a comfortable retirement

Q126: A financial goal that would be important