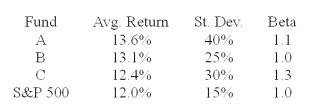

The average returns, standard deviations and betas for three funds are given below along with data for the S&P 500 index. The risk free return during the sample period is 6%.

-You wish to evaluate the three mutual funds using the Sharpe measure for performance evaluation.The fund with the highest Sharpe measure of performance is __________.

Definitions:

Predetermined Time Standards

Established benchmarks for the time required to complete specific tasks, used for planning and evaluating productivity.

Performance Ratings

Evaluations of an individual's or entity's achievements or output against predefined standards or objectives.

Standard Setting

The process of establishing benchmarks, norms, or levels of quality that products, services, or competencies should meet or exceed.

Work Sampling

A statistical technique used to estimate the proportion of time spent by workers on various activities, through random observations over a period.

Q3: What is John's effective salary reduction if

Q15: The value of a put option increases

Q18: In 2007,U.S.securities represented _ of the world

Q19: Which one of the following is a

Q25: Hedge funds can invest in various investment

Q29: You can tax shelter only one-half of

Q34: The fact that American put values may

Q49: The greatest value to an analyst from

Q69: Tax shelters _.<br>A) postpone payment of tax

Q76: Many observers believe that firms "manage" their