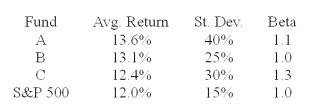

The average returns, standard deviations and betas for three funds are given below along with data for the S&P 500 index. The risk free return during the sample period is 6%.

-You wish to evaluate the three mutual funds using the Treynor measure for performance evaluation.The fund with the highest Treynor measure of performance is __________.

Definitions:

Chronosystem

A layer within Bronfenbrenner's ecological theory representing the dimension of time and its influence on a child's development.

Exosystem

A component of Bronfenbrenner's ecological systems theory, referring to external environments that indirectly influence the individual, such as parents' workplaces or the neighborhood's social conditions.

Chronosystem

In ecological systems theory, it refers to the patterning of environmental events and transitions over the life course, as well as socio-historical circumstances that affect an individual's development.

Environmental Events

Occurrences within the natural or built environment that can influence individuals' behaviors, health, and development.

Q5: Inclusion of international equities in a U.S.investor's

Q8: An option with a payoff that depends

Q21: Characteristics _ would be typical of an

Q40: Firms with higher expected growth rates tend

Q40: The Option Clearing Corporation is owned by

Q42: In planning for retirement,an investor decides she

Q50: What are the farmer's proceeds from the

Q53: Which of the following provides the profit

Q74: Eagle Brand Arrowheads has expected earnings of

Q132: The average American has [$59,000 | $81,000]