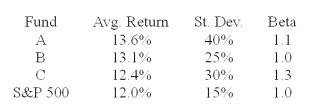

The average returns, standard deviations and betas for three funds are given below along with data for the S&P 500 index. The risk free return during the sample period is 6%.

-You wish to evaluate the three mutual funds using the Jensen measure for performance evaluation.The fund with the highest Jensen measure of performance is __________.

Definitions:

Exchange Relationship

A social relationship based on reciprocal actions where each party provides something of value to the other.

Role Clarity

The extent to which individual roles and responsibilities within an organization or group are clearly defined and understood.

Citizenship Behaviors

Voluntary and beneficial actions employees do to help others and the organization, beyond their formal duties.

Favorable Behavior

involves actions or conduct that positively impact situations or relations, often leading to beneficial outcomes or improved perceptions.

Q5: The two principal constraints which government places

Q11: Calculate the price of a call option

Q15: How many years of Social Security contributions

Q22: Refer to the financial statements of Flathead

Q39: The risk that a downturn in the

Q40: A bank has made long term fixed

Q44: Annuity income is positively correlated with _.<br>I.longevity<br>II.durability

Q51: In a defined benefit pension plan,the _

Q67: The nominal interest rate is 6%.The inflation

Q74: The arbitrage profit implied by these prices