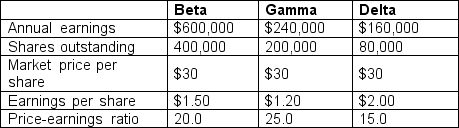

Beta Corporation is a manufacturing firm that is considering two acquisition targets.Gamma is a computer firm,while Delta is a manufacturing company.The relevant data are as follows:

The basis for the merger will be a share-for-share exchange based on market prices,and the share value of the combined firm is expected to remain unchanged.What would be the immediate effect of the two mergers on Beta Corp.'s earnings per share and price-earnings ratio? What other factors are important in Beta's analysis of its merger possibilities?

Definitions:

Impulsivity

The tendency to act on urges and desires without considering the consequences, often leading to hasty or poorly thought-out decisions.

Obesity

A medical condition characterized by excessive body fat that increases the risk of health problems.

Self-Control

The ability to regulate one's emotions, thoughts, and behavior in the face of temptations and impulses.

Regulating Behaviors

Involves controlling or guiding one's actions or responses according to social norms, personal values, or psychological principles.

Q7: A firm has 2 million shares outstanding,which

Q23: An investor enters a short position worth

Q24: A firm has $45,000,000 of preferred shares

Q26: Montreal Dealers Inc.(MD),a Canadian underwriting firm,has just

Q27: A prospectus is mandatory for all securities

Q35: A firm has a capital structure that

Q40: Why do we add the present value

Q49: The standard Black-Scholes option pricing model applies

Q55: Which of the following is the best

Q125: Michael Porter argues that firms can create