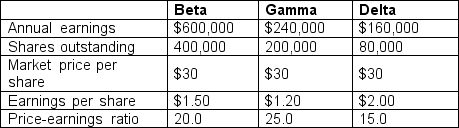

Beta Corporation is a manufacturing firm that is considering two acquisition targets.Gamma is a computer firm,while Delta is a manufacturing company.The relevant data are as follows:

The basis for the merger will be a share-for-share exchange based on market prices,and the share value of the combined firm is expected to remain unchanged.What would be the immediate effect of the two mergers on Beta Corp.'s earnings per share and price-earnings ratio? What other factors are important in Beta's analysis of its merger possibilities?

Definitions:

Product Misuse

The incorrect, inappropriate, or unintended use of a product, which can lead to injury or failure to meet the user's needs.

Unforeseeable Way

A scenario or event that could not be predicted or anticipated, often used in legal contexts to describe accidents or events beyond control.

Contributory Negligence

This is a legal defense where the plaintiff is partially at fault for the injury or damage they have suffered, which can reduce or eliminate their entitlement to damages.

Negligent

Failing to take proper care in doing something, leading to damage or harm to another.

Q6: Vancouver Salmon Farm Inc.'s current operations will

Q12: Use the following statements to answer this

Q12: Concordia Partners (CP)has recently underwritten a firm

Q19: Evaluate the following statement:<br>A short-form prospectus is

Q20: Use the following statements to answer this

Q24: You are the manager of a sales

Q46: Which of the following statements about family

Q54: Which of the "Greeks" measures the change

Q55: Suppose Montreal Import Company has to pay

Q68: Use the following two statements to answer