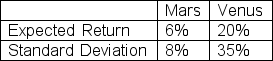

Suppose you observed the following data on two securities: Mars and Venus:

You short sold 200 shares of Mars at $20 per share and purchased 400 shares of Venus at $25 per share to increase the possible return on the portfolio.The correlation between the securities is 0.30.What is the standard deviation of the portfolio?

Definitions:

Present Value

The computed present value of a future monetary sum or cash flow sequence, utilizing an established rate of return.

Growth Opportunities

Potential scenarios or plans a business can embark on to increase profits, expand its operations, or enter new markets.

Abnormal Earnings

Income that deviates significantly from what is typical or expected, usually referring to profits significantly higher or lower than those typical for the industry or the company's history.

Valuation Approach

The methodologies and procedures used to determine the value of an asset, a company, or a financial instrument.

Q1: Jay writes a call option with a

Q22: refers to the relationship between interest rates

Q30: The closing prices for Stock B from

Q37: Use the following statements to answer these

Q39: For a given effective annual rate,the quoted

Q43: Characteristics of futures contracts include<br>A) I, II,

Q49: When a business faces capital rationing,what discount

Q50: The Dividend Discount Model (DDM)links common share

Q57: In case of bankruptcy and liquidation of

Q62: What is the expected return from an