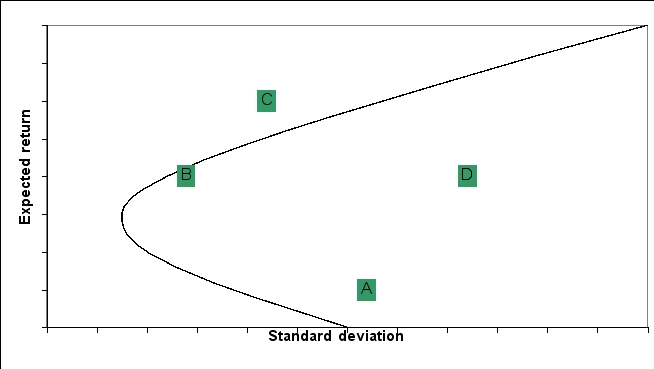

The standard deviation and expected returns for 4 portfolios (A,B,C,and D) are graphed on the following efficient frontier:  Which of the following portfolios are inefficient?

Which of the following portfolios are inefficient?

Definitions:

Labor Price Variance

The difference between the actual cost of labor and the budgeted or standard cost of labor, used in budgeting and cost management.

Materials Quantity Variance

The difference between the actual quantity of materials used in production and the expected amount, which can indicate efficiency or waste.

Standard Price

The predetermined cost assigned to materials, labor, and overhead, used in budgeting and variance analysis.

Labor Variances

Differences between the actual labor costs incurred during production and the standard or expected labor costs, which can indicate efficiencies or inefficiencies.

Q9: Which one of the following is NOT

Q20: The following information was reported last year:<br>

Q33: An investor can consistently make excess profits

Q62: What does the retention ratio measure?<br>A) Contribution

Q69: A firm has set a budget constraint

Q72: If a firm uses a constant WACC

Q78: It is now October 25.Jenny has just

Q79: Which of the following is NOT a

Q100: Suppose you plan to create a portfolio

Q103: Jack had an investment return of -24