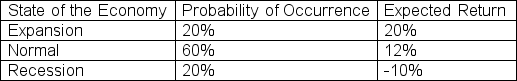

Suppose you are given the following forecasts for the economy and Sneezy Company at the beginning of the year:

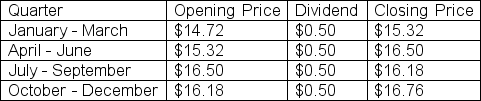

During the year,you observed the following:

A) Calculate the ex-ante expected return

B) Calculate the ex-ante standard deviation of returns

C) Calculate the ex-post average return

D) Calculate the ex-post standard deviation of returns

Definitions:

Variable Costs

Costs that change in proportion to the level of activity or volume of production, such as raw materials and labor expenses.

Fixed Costs

Expenses that do not change with the level of production or sales, such as rent, salaries, and insurance, offering predictability in budgeting.

Operating Leverage

A measure of the relative mix of a business’s variable costs and fixed costs, computed as contribution margin divided by operating income.

Highly Automated Industries

Sectors that rely extensively on automation and machinery to produce goods or deliver services with minimal human intervention.

Q5: Assume the following: underlying asset spot $200,storage

Q11: Agency problems are best defined as<br>A) difficulties

Q12: Which one of the following is NOT

Q14: What is the difference between invested capital

Q43: Consider a project that requires an immediate

Q58: What is the current yield of a

Q63: A zero coupon bond with a face

Q75: The expected returns for Hickory Inc.and Dickory

Q80: Polar Express Corporation has just reported a

Q122: Mont Royal Lighting Corporation is considering investing