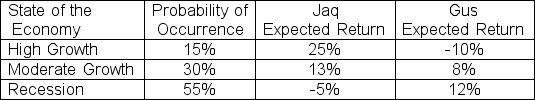

Cinderella plans to form a portfolio with two securities: Jaq and Gus.The correlation between the two securities is -1.Given the following forecasts,what are the weights in Jaq and Gus that will set the standard deviation of the portfolio equal to zero?

Definitions:

Q8: If the capital markets are efficient,then the

Q22: Francis is long the underlying and has

Q33: List the different steps in the percentage

Q33: Lottery A pays $1,000 today and Lottery

Q34: A share of Oedipus Construction Company was

Q36: Which of the following is NOT true

Q43: Empirical support for market efficiency is strongest

Q49: When a business faces capital rationing,what discount

Q78: Montreal Financial Services Company offers a perpetuity

Q115: The NPV break-even operating cash flow is:<br>A)