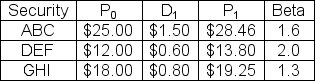

The risk-free rate is 4 percent.The expected return on the market portfolio is 12 percent with a standard deviation of 16 percent.Which security is over,under,or correctly priced?

Definitions:

Upper Quintiles

Refers to the top 20% of a population in terms of income or wealth distribution.

Line L

Represents the relationship between the quantity of labor hired and the amount of output produced, often used in economics to illustrate productivity.

Income Received

The total amount of money received by an individual or entity during a specified time frame, from all sources.

Highest Quintile

Refers to the top 20 percent of the population or distribution in terms of income, wealth, or other measurable attributes.

Q5: Financial markets are usually classified by the

Q11: A key relationship among the conceptual framework

Q20: Elvira is considering buying a 20-year annuity

Q29: Contrast the differences between rules-based standards and

Q65: What is the standard deviation of an

Q76: Theoretically,what is meant by the market portfolio?<br>A)

Q92: The percentage-of-completion method conforms to the matching

Q98: Baxter Company issues its annual financial reports

Q112: The Basis for Conclusions found in accounting

Q120: Information that is not material is never