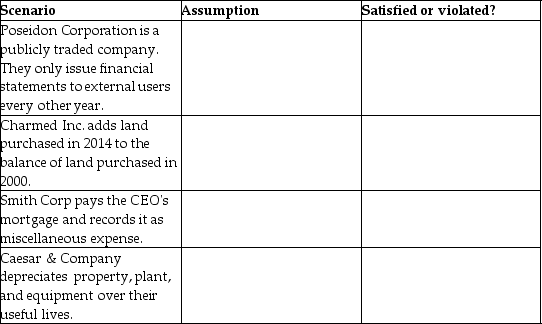

Identify the assumption represented in each scenario,the decide if it is satisfied or violated.

Definitions:

Average Tax Rate

The percentage of total taxable income that is paid in taxes, calculated by dividing the total tax paid by the total taxable income.

Taxable Income

The portion of income that is subject to taxation after allowances, deductions, and exemptions.

Progressive Taxes

A tax system in which the tax rate increases as the taxable amount increases, meaning higher income individuals pay a higher percentage of their income in taxes.

State and Local Taxes

Taxes imposed by state and local government entities that can include income, sales, and property taxes.

Q6: You've been assigned to write a research

Q23: The expected returns for Securities ABC and

Q30: Official U.S.GAAP consist of the bulletins,opinions,and statements

Q32: Revenues are considered earned when a company

Q48: _ is the amount at which a

Q49: Numerical references to the Accounting Standards Codification

Q53: The Private Company Council has authority to

Q57: Elements of other comprehensive income are primarily

Q69: The current price of Stock Y is

Q128: Accumulated other comprehensive income is included in