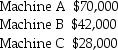

Seeder Inc.made a lump-sum purchase of three pieces of machinery for $130,000 from an unaffiliated company.At the time of acquisition,Seeder paid $5,000 to determine the appraised value of the machinery.The appraisal disclosed the following values:  What cost should be assigned to Machines A,B,and C,respectively?

What cost should be assigned to Machines A,B,and C,respectively?

Definitions:

Classical View

A perspective on management and organizational theory that emphasizes efficiency, hierarchical structure, and the importance of planning and formal procedures.

CSR

Corporate Social Responsibility (CSR) refers to a company's commitment to operate in an economically, socially, and environmentally sustainable manner.

Shareholders

Shareholders are individuals or entities that own shares in a corporation, giving them partial ownership and possibly the right to vote on corporate matters.

Corporate Governance

The framework of rules, practices, and processes by which a company is directed and controlled, ensuring accountability and aligning with stakeholders' interests.

Q36: The expected cash flow approach encompasses all

Q46: On January 1,Yumati Electric borrows $333,333 at

Q70: Generally,which of the following costs are capitalized

Q84: Refer to Camey Construction.How much gross profit

Q91: Derecognition of debt occurs when all of

Q111: On January 2,2017,Edmond,Inc.issued 8,000 bonds at $1,040

Q117: Which of the following is not a

Q130: When bonds are sold between interest dates,the

Q130: Both U.S.GAAP and IFRS requires disclosure of

Q142: When a bond sells at 102,this means