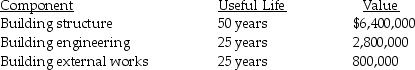

Presented below are the components related to an office building that Lorny Manufacturing Company purchased for $10,000,000 in January,2017.

a.Compute depreciation expense for 2017,assuming that Lorny uses component depreciation,uses the straight-line method of depreciation,and ignores scrap values.

a.Compute depreciation expense for 2017,assuming that Lorny uses component depreciation,uses the straight-line method of depreciation,and ignores scrap values.

b.Assume that the building engineering was replaced after 20 years at a cost of $2,500,000.Prepare the journal entry to record the replacement of the old component with the new component.

Definitions:

Q14: All fixed assets with a useful life

Q34: Bakiponi Corp.provides the following data from its

Q58: Which of the following is not a

Q58: Marston Company has outstanding accounts receivable totaling

Q62: On July 1,2017,Behi Corporation issues $100,000 of

Q63: How long is the company's operating cycle?<br>A)75

Q89: Under IFRS,the firm may base impairment test

Q100: When the bonds are converted,the fair value

Q113: Miller,Inc.sold $2,000,000 of bonds at par on

Q120: Goodwill is recorded as an intangible asset