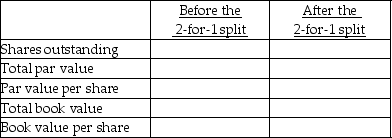

Betta Corporation issued 300,000 shares of $2 par value stock.The book value of Betta's common stockholders' equity is equal to $30 million.Betta implements a two-for-one stock split.Complete the following table:

Definitions:

Market Risk Premium

The supplementary income expected by an investor from maintaining a risky market portfolio rather than holding risk-free investments.

Required Return

The minimum return that an investor expects to achieve on an investment, considering the risk associated with it.

Risk-free Rate

The theoretical return of an investment with zero risk, often represented by the yield on government securities.

Beta

Beta is a measure of a stock's volatility in relation to the overall market; a beta greater than 1 indicates higher volatility, while a beta less than 1 indicates lower volatility.

Q2: Muir,lad.measures its trading securities at fair value.It

Q11: An employee will not redeem a liability-classified

Q51: Lyon Ltd.,a U.S.GAAP reporter,provides the following information:<br>Sales

Q57: _ receive dividend distributions after the company

Q70: Which of the following is not a

Q81: As of 12/31/17,XYZ Inc.had Available-for-Sale debt investments

Q85: A deferred tax asset represents a future

Q94: Under the IFRS one-step impairment test,an assets

Q113: Ewok Enterprises recently elected the fair value

Q125: u.S.GAAP requires significant disclosures for goodwill,including all