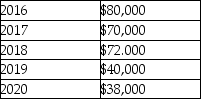

On December 31,2015,Big Bear Corporation reports liabilities with a tax basis of $1,000,000 and a book basis of $1,300,000.There was no difference in the asset basis.The difference in liability basis arose from temporary differences that would reverse in the following years:  Assuming a tax rate of 30% for 2015 - 2018 and a rate of 35% for 2019 - 2020,what should Big Bear report on its balance sheet on December 31,2015?

Assuming a tax rate of 30% for 2015 - 2018 and a rate of 35% for 2019 - 2020,what should Big Bear report on its balance sheet on December 31,2015?

Definitions:

Formal Research

A structured process of investigating issues or questions to gain new knowledge, using systematic methods to collect and analyze data.

Routine Business Messages

Routine business messages refer to standard or everyday communications within a business environment, often dealing with operational or administrative matters.

Stylistic Emphasis

The use of specific stylistic elements to highlight or draw attention to important parts of a text or presentation.

Mechanical Means

Methods or techniques that involve machinery or tools to achieve a result.

Q22: On January 1,2014,TNT,Inc.issued 1,500 shares of $50

Q42: Under U.S.GAAP,companies generally use a cash flow

Q46: Under IFRS,the balance sheet presentation for deferred

Q63: Income available to common shareholders is net

Q66: In which of the following instances would

Q95: A change in reporting entity must be

Q113: Lyon Corp reported income from continuing operations

Q187: Under the equity method,the investor decreases the

Q334: JAT Corp.loaned $375,000 for three years to

Q365: Which one of the following is not