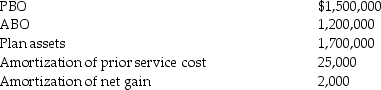

Pension data for John Ferguson Company include the following for the current calendar year:

Discount rate: 7%

Expected return on plan assets: 11%

Actual return on plan assets: 10%

Service cost: $250,000

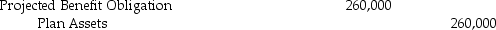

January 1:

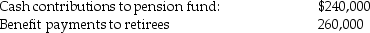

December 31:

December 31:

Required:

Required:

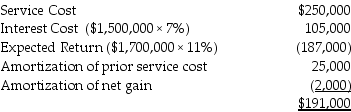

1.Determine pension expense for the year.

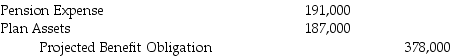

2.Prepare the journal entries to record pension expense and funding and distributions to employees for the year.

2.Prepare the journal entries to record pension expense and funding and distributions to employees for the year.

Definitions:

Interest Rate Risk

The potential for investment value fluctuations due to changes in the prevailing interest rates.

Maturity

The specified time at which the principal amount of a bond, loan, or other financial instrument is due to be paid in full.

Coupon Bond

A type of bond that pays the holder a fixed interest rate (coupon) over the bond's lifespan and repays the principal at maturity.

Yield To Maturity

The expected total yield from a bond assuming it is retained until the end of its term, accounting for all interest earnings and the return of the initial investment.

Q5: Blue Corporation is an IFRS reporter.Blue's income

Q14: Why would a company issue a stock

Q56: Which of the following is not an

Q62: An increase in a accounts receivable,all other

Q67: Summarize the the financial disclosure requirements for

Q101: A guaranteed residual value reduces the amount

Q111: Refer to Black Corporation: Assume that these

Q141: Which of the following statements is incorrect

Q355: When year-end occurs between payment dates,the lessee

Q365: Which one of the following is not