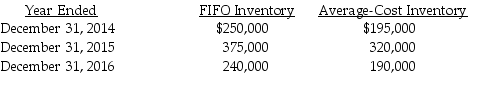

Butler Products decided to change inventory methods on January 1,2016 to more effectively report its results of operations.In the past,management has measured its ending inventories by the average-cost method and they now believe that FIFO is a better representation of its financial position and profitability.Butler's tax rate is 35% for all years.  Which one of the following journal entries correctly records the change in the accounting principle?

Which one of the following journal entries correctly records the change in the accounting principle?

Definitions:

Grievance Interview

A formal meeting between an employer and an employee to address and resolve complaints or issues raised by the employee.

Informational Interview

An interview conducted to gather information about a job, career field, industry, or company from someone who has knowledge and experience in that area.

Performance Interview

A formal discussion between an employee and manager focused on evaluating the employee's job performance and setting future goals.

Interrogation Interview

A questioning process, often in a formal or official context, aimed at gathering information or confirming details, sometimes associated with law enforcement.

Q14: Hyde Company leased equipment to Pittman Corporation

Q17: When a company adjusts the balance of

Q28: Changes in current assets relate to operating

Q69: For Trading Securities,companies must disclose the amortized

Q77: What amount should Fields recognize as compensation

Q82: Hudson Motors reported $535,000 net income for

Q109: What is the initial reporting basis for

Q111: Temporary differences between the book and tax

Q318: Reconstruct the table with corrected amounts.<br> <img

Q321: At the end of 2015,the payroll supervisor