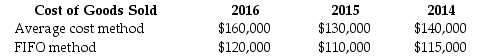

Machino,Inc.began operations on January 1,2014.During 2016,management decided to change from average-cost method to FIFO for its merchandise inventories.The change was effective at January 1,2016.Management determined that cost of goods sold for each method would be:

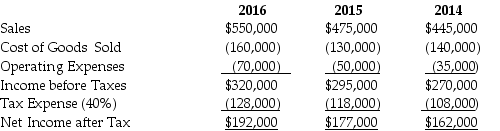

The company's statements as reported under average-cost before implementing the accounting change for 2016,2015,and 2014,respectively,are presented below.The income tax rate for Machino is 40%.

The company's statements as reported under average-cost before implementing the accounting change for 2016,2015,and 2014,respectively,are presented below.The income tax rate for Machino is 40%.

Required:

Required:

Definitions:

Payroll Items

Components that make up the total compensation package on an employee's pay, including wages, salaries, benefits, taxes, and deductions.

Employer Responsibility

Obligations that an employer has towards their employees, which may include providing a safe working environment, fair wages, and complying with employment laws.

Employee Responsibility

The obligation of employees to complete assigned tasks, adhere to the company's policies, and act in the company’s interest.

Q54: In November and December 2013,Bee Company,a newly

Q65: Big Bear Sporting Goods opened in 2015.They

Q72: Net pension liability is decreased by _.<br>A)amortization

Q76: Increases in current liabilities cause operating cash

Q138: For a lease to be classified as

Q181: For an operating lease,the lessee is only

Q189: One disadvantage of leasing an asset is

Q272: Sumner leases a copier from Jenks Corporation

Q273: Under U.S.GAAP,which of the following may be

Q381: An decrease in a deferred tax asset