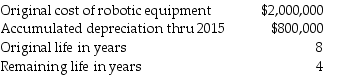

Jenkins,Inc.builds custom machines for manufacturers using robotic equipment.In 2016,the company decided to change from straight-line to double-declining-balance depreciation for its robotic equipment.It changed the life expectancy as follows:

Determine the correct amount of depreciation to expense for 2016.

Determine the correct amount of depreciation to expense for 2016.

A)$250,000

B)$300,000

C)$400,000

D)$600,000

Definitions:

Purchasing Agent

A professional responsible for acquiring goods or services for their employer through negotiating price and terms.

Delivery Driver

An individual responsible for transporting goods from one place to another.

Mechanic

A professional skilled in the repair and maintenance of machinery, vehicles, or other technical equipment.

Janitor

A person employed to clean and maintain a building, such as an office, a school, or a residential complex.

Q1: Anzelmo Corporation invested in Jones Manufacturing by

Q15: Dante Inc.reported fines and penalties on their

Q17: Which of the following errors will be

Q19: The primary measurement basis currently used to

Q27: List and explain the three methods used

Q70: Greenwell Coffee Company began operations on the

Q75: Which of the following is not a

Q91: Which of the following statements is true

Q213: When a large corporation purchases a new

Q228: Which of the following is not a