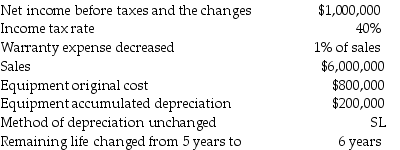

In reconciling information to complete its financial statements,Biltmore,Inc.discovered the following situations:

Required: Assuming that no depreciation had been recorded,recompute depreciation expense,warranty expense change,net income before taxes,income tax expense,and net income.

Required: Assuming that no depreciation had been recorded,recompute depreciation expense,warranty expense change,net income before taxes,income tax expense,and net income.

Definitions:

Adjusting Entries

Toward the end of an accounting period, entries are made to attribute revenues and expenditures to the period in which they essentially occurred.

Stockholders' Equity

The residual interest in the assets of the entity after deducting liabilities, representing the ownership interest of shareholders.

Depreciation Expense

The amount of an asset’s cost that is allocated as an expense over a specific accounting period, reflecting its usage and wear and tear.

Accrued Sales Revenue

Revenue that has been earned but not yet received in cash or recorded by the accounting department.

Q14: Refer to Violet Corporation.What is the necessary

Q17: Which of the following errors will be

Q41: The order for antidilutive sequencing is ranking

Q53: The conceptual model for the statement of

Q63: Anzelmo Corporation invested in Jones Manufacturing by

Q81: On December 31,2015,The Magic Flute Company reports

Q90: Walker Corporation has three potentially dilutive securities.Net

Q106: When a company grants a liability-classified award,it

Q312: In a sales-type capital lease,the lessor expenses

Q328: Changes in depreciation methods are changes in