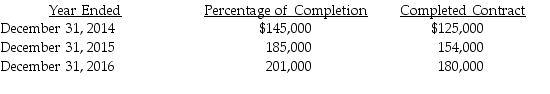

Hampton's Construction,Inc.decided to change from completed-contract method of accounting to percentage-of-completion method.Hampton will continue to us the completed-contract method for income tax purposes.The following information is available for net income.The income tax rate for all years is 35%.

What is the journal entry to record the change in accounting principle on January 1,2016?

What is the journal entry to record the change in accounting principle on January 1,2016?

Definitions:

Opportunity Cost

The expense incurred by not choosing the second-best option available while deciding.

Cash Outlay

The actual amount of money spent or required to be spent on a particular expense, project, or acquisition.

Alternative Investments

Investment assets that do not fall into conventional categories such as stocks, bonds, or cash, including real estate, hedge funds, or commodities.

Differential Revenue

The difference in revenue between two alternatives, often used in decision making to understand the financial impact of different choices.

Q24: Gallagher Corporation's book income before taxes is

Q45: In what ways must an accountant exercise

Q63: Which of the following is NOT a

Q80: The appropriate accounting method for equity investments

Q85: According to the FASB's conceptual framework,which of

Q91: Muckingjay Inc.opened in 2015.The company reported sales

Q97: Which of the following statements regarding disclosures

Q136: Braun Corp.purchased a service vehicle liability policy

Q222: In a statement of cash flows,the cash

Q341: Which of the following is not among